It took just two months and a few billion dollars for China General Nuclear Power Group (CGN) to become one of the largest providers of clean energy in Brazil. Between May and July, the company acquired two solar power plants – including the second largest in the country – and six wind farms.

Chinese companies were already a powerhouse in Brazil’s energy sector, owning about 10% of the country’s capacity, mostly because of big acquisitions in recent years by State Grid and China Three Gorges; not to mention the thousands of kilometers of transmission lines being built.

But the new move by CGN solidified China’s presence in Brazil’s flourishing new energy market. According to a Diálogo Chino analysis of public records, the new investments mean Chinese companies now own 16% of Brazil’s wind power capacity and 21% of its solar capacity, or 2,822 megawatts in total.

José Mauro de Morais, a researcher specialising in wind power at Brazil’s Institute for Applied Economics Research, says Chinese companies are attracted by a flourishing market tending towards growth.

Between 2013 and 2019, renewable sources went from representing 78.7% of Brazil’s energy matrix to 83.2%. The growth is due to the proliferation of wind and solar power. Wind went from representing 1.7% to 9% in six years, while solar went from zero to 1.7%. Meanwhile hydropower’s share fell.

“These power plants are very competitive. They can compete with thermal power plants, fossil fuel ones,” he said. “China sees that. There is a lot of space for renewable energy in Brazil.”

Race for Chinese investments

In May, CGN bought two of the biggest solar power plants in Brazil, Nova Olinda and Lapa, from the Italian company Enel, which owns the largest solar portfolio in Brazil. Two months later, in July, it bought Brazil’s Atlantic and its hefty wind power portfolio that includes some of the most important plants in the country.

The new investments have fed expectations that more is to come. José Roberto de Moraes, the CEO of Atlantic, has spent the last week taking Chinese executives to several different states to see projects being developed, meet government officials and prospect for new investments.

“There is a disposition on their part to invest not only in solar power, but also wind. With that, maybe new projects will follow,” he said. “That’s an expectation. We have to wait and see.”

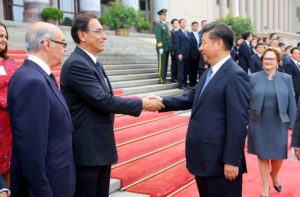

Meanwhile, Brazilian officials are running to China to shake hands and present their projects. Governors from a few states have visited China this year, including the governors of Piauí and Bahia, two of the states CGN is investing in.

“Piauí was one of the chosen states!,” governor Wellington Dias of Piauí wrote hours before he hopped on a plane to China on a mission to seek more investment last week.

According to his government, CGN is investing 3.7 billion reais (US$940 million) in energy projects between Bahia and Pauí.

The move could also be strategic for the Chinese companies that produce turbines and solar panels, as many expect the newly acquired power plants to run on Chinese technology.

“This will force Brazilian companies to be more competitive,” said Morais. “This strengthens the trend of lower prices.“

Great potential

The last auction the Brazilian government opened in June reached record low prices for the sale of energy produced by both solar and wind power plants, meaning companies are willing to accept less money to sell the electricity they produce.

The scenario is good news for Brazil, which still relies heavily on hydropower plants that are becoming increasingly controversial. In recent years, construction has begun on several hydropower plants in the Brazilian Amazon, prompting activists and indigenous communities to protest their huge social and environmental impact.

Hydropower’s vulnerability to the weather has also been a thorn in the Brazilian government’s side. Between 2011 and 2015, while the country was facing fierce droughts, the government was forced to increase the share of fossil fuels in the energy matrix, which meant electricity prices rose sharply throughout the country. Solar and wind power plants could fill that space.

83.2%

of Brazil’s energy come from renewable sources

This year, low water levels in dammed reservoirs have already prompted the government to resort to fossil fuel power plants, which will likely increase prices once again.

Brazil has great potential to produce cheap wind and solar energy. According to Morais, the average utilisation of a wind power plant in Brazil is much higher than in other countries. This is measured by the capacity factor, which is the proportion of energy capacity put out over a given period of time. According to an information sheet published by the Brazilian government, Brazil wind farms have an average capacity factor of 42%, while the world average is 25%.

In China it’s 16%. Northeastern states such as Rio Grande do Norte and Piauí, where CGN is investing, are among the best positioned to provide wind power.

Solar is no different. Though Brazil isn’t among the countries that receive the most solar radiation, like Australia, it has more potential than most of Europe. In some states, such as Bahia and Minas Gerais, solar radiation can reach 6.5 kilowatt hours per square metre per day – almost double the highest radiation seen in solar energy leader Germany, of 3.4 kilowatt hours.